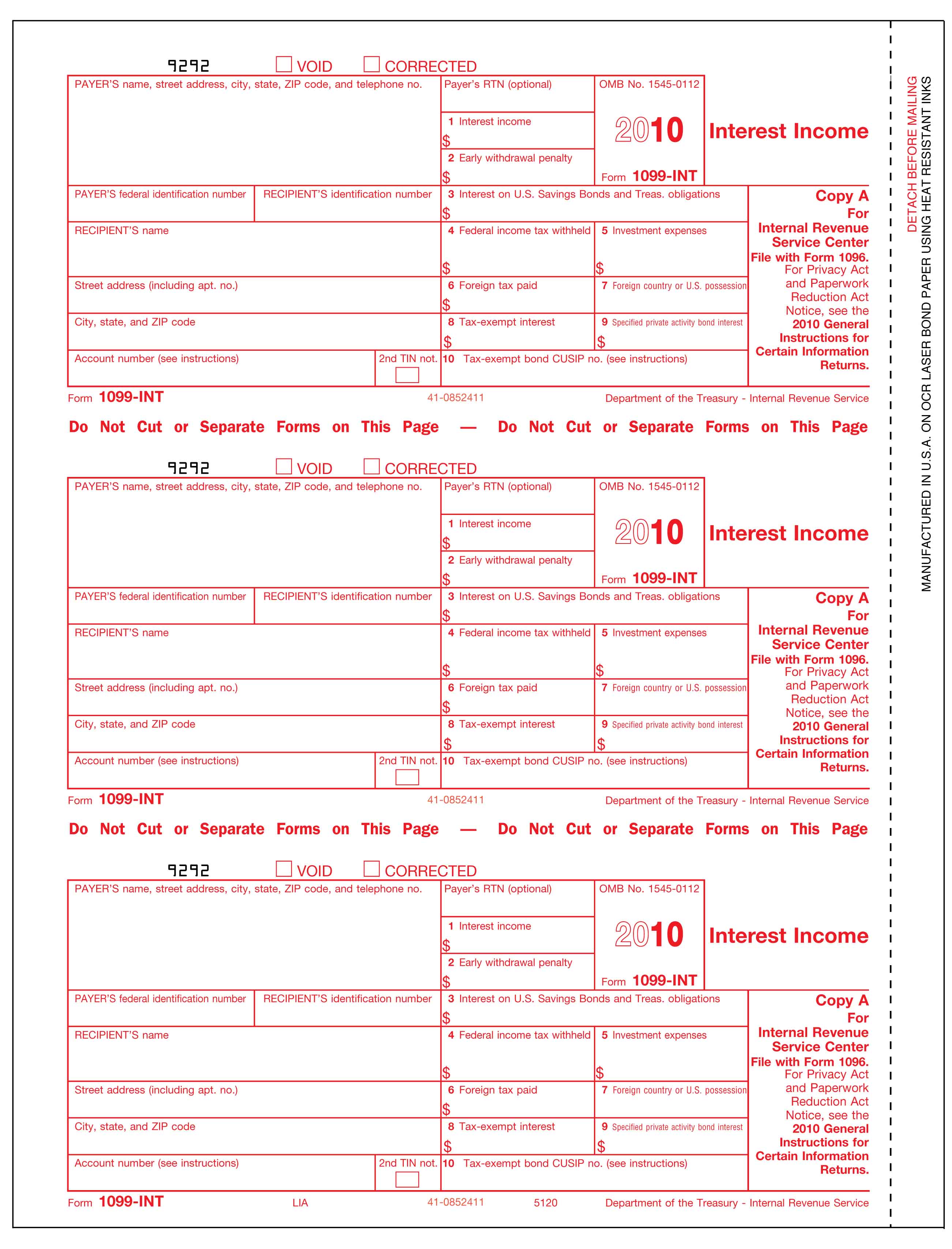

2025 Tax Forms 1099. There are several variants of 1099s, but the. If you meet the applicable threshold, you’ll receive form.

If you meet the applicable threshold, you’ll receive form. Taxact and ebay have partnered to explain these tax changes and what they mean for your tax return.

IRS Form 1099DIV, Dividends and Distributions How to File, What is a 1099 tax form? If you meet the applicable threshold, you’ll receive form.

1099 Form Fillable Printable Forms Free Online, This tax return and refund estimator is for tax year 2025 and currently based on 2025/2025 tax year tax tables. What is a 1099 tax form?

Printable 1099 Tax Forms, This tax return and refund estimator is for tax year 2025 and currently based on 2025/2025 tax year tax tables. Your 2025 through 2025 tax.

IRS W9 and 1099 Forms (Full Guide) Free Form Downloads, Once you hit a certain threshold in payments. What is a 1099 tax form?

1099 Format, 1099 Forms, 1099 Tax Forms Print Forms, Here's everything we know about how the new irs free tax filing software works and how the program will expand for the 2025 tax filing season. What is irs direct file?

1099, Your 2025 through 2025 tax. Do not file draft forms and do not rely on information in draft instructions or publications.

What is a 1099? Types, details, and who receives one QuickBooks, There are several variants of 1099s, but the. For this, they need to document gains and losses from crypto.

All you need to know about the 1099 form Skuad, There are several variants of 1099s, but the. There are various types of 1099s, depending on the type of income in.

How To Use the IRS 1099NEC Form FlyFin, Once you hit a certain threshold in payments. For a full list of 1099 forms, including descriptions and online tax filing instructions, see our 1099 forms and.

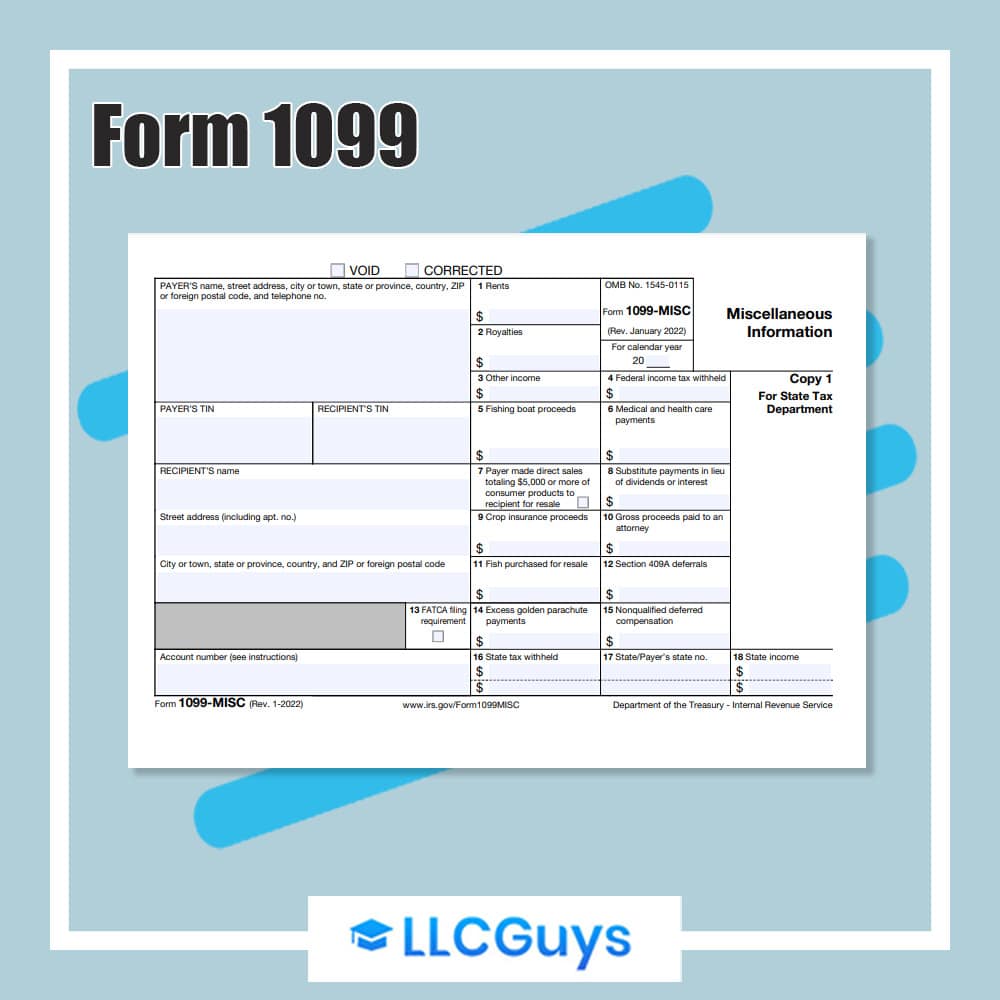

Tax Form 1099MISC Instructions How to Fill It Out Tipalti, For a full list of 1099 forms, including descriptions and online tax filing instructions, see our 1099 forms and. As it stands, the threshold is expected to drop again to $600 for tax year 2025, unless the irs makes more changes.

As it stands, the threshold is expected to drop again to $600 for tax year 2025, unless the irs makes more changes.